| • | | During Fiscal 2020, our leadership team, Board of Directors, and employees provided financial and volunteer support to a variety of non-profit organizations, including the United Way, Philabundance, the Central Pennsylvania Food Bank, Helping Harvest, American Red Cross, the Salvation Army, and Reading is Fundamental.

In alignment with our values to promote diversity and inclusion, the Company created the Belonging, Inclusion, Diversity, & Equity (“BIDE”) Initiative. The BIDE Initiative provides the organizational blueprint for achieving greater diversity and uniqueness of individuals and cultures and the varied perspectives they provide throughout the organization. The Company committed to a minimum contribution of $500,000 to partner organizations in our local communities to combat racial inequality and systemic racism. As part of this initiative, the Company established new partnerships with the Urban Affairs Coalition and Big Brothers Big Sisters, further demonstrating UGI’s commitment to the communities it serves. We believe that, by fostering an environment that exemplifies our core value of Respect, we gain unique perspectives, backgrounds and varying experiences to ensure our continued long-term success.

We believe that the safety and well-being of our employees, customers, and communities is of the utmost importance. Safety is the top priority for our business. UGI and its businesses continue to invest in programs, technology, and training to improve safety throughout our operations. We believe that the achievement of superior safety performance is both an important short-term and long-term strategic initiative in managing our operations. Safety is included as a component of the annual bonus calculation for executives and non-executives, reinforcing our commitment to safety across our organization.

Voting Matters and Board Recommendations | | | | | Proposal | | Required Approval | | Board Recommendation | Election of Ten Directors

| | Majority of Votes Cast | | FOR | | | | Advisory Vote on Executive Compensation

| | Majority of Votes Cast | | FOR | | | | Approval of the Company’s 2021 Incentive Award Plan

| | Majority of Votes Cast | | FOR | | | | Ratification of Independent Registered Public Accounting Firm for 2021

| | Majority of Votes Cast | | FOR |

| Proposal | | Required Approval | | Board Recommendation | | Election of Ten Directors | | Majority of Votes Cast | | FOR | | Advisory Vote on Executive Compensation | | Majority of Votes Cast | | FOR | | Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation | | Majority of Votes Cast | | 1 Year | | Ratification of Independent Registered Public Accounting Firm for Fiscal 2023 | | Majority of Votes Cast | | FOR |

How to Cast Your Vote | | | | | Over the Internet | | By Telephone | | By Mail or in Person | If your shares are registered in your name: Vote your shares over the Internet by accessing the Broadridge proxy online voting website at:

|

| Over the Internet | | By Telephone | | By Mail or in Person | | If your shares are registered in your name: Vote your shares over the Internet by either scanning the QR Barcode on your Notice of Availability of Proxy Materials, or by accessing the Broadridge proxy online voting website at: www.proxyvote.com and following the on-screen instructions. You will need the control number that appears on your Notice of Availability of Proxy Materials when you access the web page. | | If your shares are registered in your name: Vote your shares over the telephone by accessing the telephone voting system toll-free at 1-800-690-6903 and following the voting instructions. The telephone instructions will lead you through the voting process. You will need the control number that appears on your Notice of Availability of Proxy Materials when you call. | | If you received these Annual Meeting materials by mail: Vote by signing and dating the proxy card(s) and returning the card(s) in the prepaid envelope. instructions. You will need the control number that appears on your Notice of Availability of Proxy Materials when you access the web page. If your shares are held in the name of a broker, bank or other nominee: Vote your shares over the Internet by following the voting instructions that you receive from such broker, bank or other nominee.

| | If your shares are registered in your name: Vote your shares over the telephone by accessing the telephone voting system toll-free at 1-800-690-6903 and following the voting instructions. The telephone instructions will lead you through the voting process. You will need the control number that appears on your Notice of Availability of Proxy Materials when you call.

If your shares are held in the name of a broker, bank or other nominee: Vote your shares over the telephone by following the voting instructions you receive from such broker, bank or other nominee.

| | If you received these annual meeting materials by mail: Vote by signing and dating the proxy card(s) and returning the card(s) in the prepaid envelope.

Shareholders may vote at the meeting. You may vote your shares by accessing the annual meeting website at www.virtualshareholder

meeting.com/UGI2021 and clicking on the Vote Here button. You may also be represented by another person at the meeting by executing a proper proxy designating that person. If you are a beneficial owner of shares, you must obtain a legal proxy from your broker, bank or other holder of record and present it to the Judge of Election with your ballot to be able to vote at the Meeting. You may vote your shares by accessing the Annual Meeting website at www.virtualshareholdermeeting.com/

UGI2023 and clicking on the Vote Here button.

| | | | | | | | If your shares are held in the name of a broker, bank or other nominee: Vote your shares over the Internet by following the voting instructions that you receive from such broker, bank or other nominee. | | If your shares are held in the name of a broker, bank or other nominee: Vote your shares over the telephone by following the voting instructions you receive from such broker, bank or other nominee. | | You may also be represented by another person at the Meeting by executing a proper proxy designating that person. If you are a beneficial owner of shares, you must obtain a legal proxy from your broker, bank or other holder of record and present it to the Judge of Election with your ballot to be able to vote at the Meeting. |

| Performance Highlights – Fiscal 2022 |

UGI Corporation (the “Company”) reported diluted earnings per share of $4.97 and adjusted diluted earnings per share of $2.90 for the fiscal year ended September 30, 2022 (“Fiscal 2022”). Adjusted earnings per share exclude (i) the impact of changes in unrealized gains and losses on commodity and certain foreign currency derivative instruments not associated with current period transactions, (ii) business transformation expenses, (iii) impairments of certain equity method investments and assets, (iv) debt extinguishment, (v) the impact of a change in tax law, and (vi) restructuring costs. The Board of Directors increased the annual dividend rate during Fiscal 2022 by approximately 4.3% (the 35th consecutive year of annual dividend increases). As described in more detail below, we continued to make progress on our environmental, social and governance (“ESG”) initiatives during Fiscal 2022 through our dedicated ESG team and advancement on our commitment to the Company’s Belonging, Inclusion, Diversity and Equity (“BIDE”) initiative. In addition, we identified and communicated to our investors three key elements that we believe will advance our strategy: (1) providing reliable earnings growth; (2) investing in renewable energy solutions; and (3) rebalancing our portfolio, with an emphasis on natural gas and renewable energy solutions. The following discussion highlights some of our key accomplishments in these areas during Fiscal 2022. | • | Reliable Earnings Growth |

We are committed to consistently growing our earnings and plan to continue this growth through increased investments in our regulated utilities businesses, generating significant fee-based income in our Midstream and Marketing operations, and making strategic acquisitions at our LPG businesses. We strive to be the preferred provider in all markets we serve and remain focused on making continuous improvements and focusing on growth across our business. At our Utilities segment, we completed the acquisition of Mountaineer Gas Company in Fiscal 2021 and continued integration efforts in Fiscal 2022. In September 2022, our Pennsylvania natural gas utility company (“PA Gas Utility”) received approval from the Pennsylvania Public Utility Commission (“PAPUC”) for a two-phase annual base distribution rate increase of $49.45 million beginning in October 2022. In addition, the PAPUC approved a weather normalization adjustment rider beginning in November of 2022. At our Midstream & Marketing segment, UGI Energy Services completed the acquisition of Stonehenge in January 2022. The Stonehenge business includes a natural gas gathering system located in Western Pennsylvania, comprised of more than 47 miles of pipeline and associated compression assets. This acquisition is consistent with our growth strategies, including our goal to expand our midstream natural gas gathering assets within the Appalachian basin production region. Our Midstream and Marketing business also continues to provide a stable earnings stream, which is underpinned by fee-based contracts from customers. In Fiscal 2022, our AmeriGas Propane and UGI International segments successfully concluded transformation initiatives and we remain committed to continuous improvement as we manage through a challenging environment. Our national accounts program at AmeriGas Propane and our cylinder exchange programs at both AmeriGas Propane and UGI International are convenient for customers and position us for future growth. | • | Investment in Renewable Energy |

We are pursuing investments in a number of key renewable energy areas, including RNG, bio-LPG and renewable dimethyl ether, among others. Our natural gas businesses are actively exploring RNG opportunities involving both distribution and RNG feedstock infrastructure, and our LPG businesses are developing bio-LPG sources to augment our existing bio-LPG source in Sweden. We believe that we are particularly well-positioned to develop investment opportunities in these rapidly emerging markets due to our competencies in project development, project execution, gas transportation and storage, and energy marketing. We expect to utilize our existing natural gas and LPG distribution infrastructure to deliver RNG and bio-LPG to the customers we serve. In most cases, these renewable solutions can be delivered to our customers with no additional local infrastructure, incremental investments by our customers, or community disruption related to infrastructure buildout. In Fiscal 2022, we announced a number of projects, which we believe will provide a foundation for growth within the renewable energy space. UGI Energy Services announced investments in joint ventures to produce RNG in New York, South Dakota and Idaho. The RNG produced annually from these projects will be sold into local or interstate natural gas pipelines and the environmental credits generated by the projects will be marketed by our subsidiary. In February 2022, UGI Pennant announced that it entered into a series of agreements to accept delivery of RNG into its natural gas gathering system. The project is scheduled to become operational in 2023. When fully operational, the UGI Pennant system will take up to 6,500 Mcf (thousand cubic feet) per day of RNG supply. UGI Energy Services will manage construction of an interconnecting pipeline and interconnection with UGI Pennant. In October 2021, PA Gas Utility received regulatory approval from the PAPUC to purchase RNG as part of a five-year pilot program intended to explore how PA Gas Utility can integrate RNG into its supply portfolio to produce economic and environmental benefits for its customers. In January 2022, PA Gas Utility began accepting RNG into its pipeline distribution system pursuant to an interconnect agreement. When fully operational, the interconnect will be capable of accommodating up to 5.3 billion cubic feet of RNG supply each year. The introduction of RNG supply into PA Gas Utility’s distribution system provides benefits to the environment and to the communities we serve by lowering net carbon emissions. It is anticipated that this project will reduce CO2 emissions by an amount equivalent to removing 67,000 passenger vehicles over the course of a calendar year. In December 2021, UGI International received approval from the European Commission to launch a joint venture to advance the production and use of renewable dimethyl ether, a low-carbon sustainable liquid gas. We anticipate the development of up to six production plants within the next five years, targeting a total production capacity of 300,000 tons of renewable dimethyl ether per year by 2027. These projects provide a range of benefits, including reducing our carbon footprint while also addressing increased customer demand for low carbon energy sources, and we expect to continue to expand our renewable energy investments in the upcoming years. | • | Rebalancing Our Portfolio |

In the fiscal year ended September 30, 2019, we completed the AmeriGas Merger, whereby AmeriGas Partners became a wholly owned subsidiary of UGI and increased LPG’s contribution to UGI’s overall product mix. We announced our plan to rebalance our portfolio through both organic growth and investment in natural gas and renewable energy solutions. In Fiscal 2022, we executed on our rebalancing strategy through several transactions and investments, including the Stonehenge Acquisition and the aforementioned investments in renewable energy. In addition to these transactions and investments, UGI Utilities continued to execute on its infrastructure replacement and system betterment program, with record capital expenditures in Fiscal 2022 and additional expenditures expected in the coming years. UGI Utilities remains on schedule to achieve its goal of replacing the cast iron portions of its gas mains by March 2027 and the bare steel portion of its gas mains by September 2041. We believe that the replacement of aging infrastructure results in increased contributions to rate base growth and also reduces emissions while improving operational efficiency. We believe that corporate sustainability is critical to our overall business success and we are committed to growing the Company in an environmentally responsible way. UGI’s environmental strategy is focused on three main areas: reducing our emissions; reducing our customers’ emissions affordably, reliably, and responsibly; and investing in renewable solutions. To support our strategy, we have made the following environmental commitments discussed below while also committing to continue to grow our earnings per share and dividends. | • | Scope 1 Emissions Reduction Commitment – Reduce Scope 1 GHG emissions by 55% by 2025 (using Fiscal 2020 as a baseline). Our Scope 1 emissions reduction target does not include emissions from the Mountaineer Gas Company acquisition, which closed in September 2021. The emissions from the Pine Run acquisition, announced in February 2021, will be included in the baseline 2020 number. The 2020 base number also takes a five year emissions average from the Hunlock generation facility to account for year-over-year differences in run time. | | • | Methane Emissions Reduction Commitment – Reduce methane emissions by 92% by 2030 and 95% by 2040. | | • | Pipeline Replacement and Betterment Commitment – Replace all cast iron pipelines by 2027 and all bare steel by 2041. Our pipeline replacement and betterment activities better enable us to achieve our emissions reductions goals. | | • | Renewable Investment – Invest between $1 billion and $1.25 billion by 2025. Such renewable investments better enable us to achieve our emissions reductions goals. |

We report our progress on the environmental goals and commitments annually in our Sustainability Reports. Our Sustainability Reports may be accessed on our website under “ESG - Resources - Sustainability Reports.” Information published in our Sustainability Reports is not intended to be incorporated into this Proxy Statement. In formulating our environmental strategy, our management and Board of Directors consider certain risks and uncertainties that may materially impact our financial condition and results of operations.

Advisory Vote to Approve Named Executive Officer Compensation | | | | | Proposal | | Background | | Board Recommendation | We are asking shareholders to approve, on an advisory basis, the Company’s executive compensation, including our executive compensation policies and practices and the compensation of our named executive officers, as described in this Proxy Statement beginning on page 30. | | At our 2020 Annual Meeting, nearly 93% of our shareholders voted to approve the compensation of our named executive officers.

This result clearly demonstrated strong support for our executive compensation policies and practices and the alignment of executive pay to Company performance.

| | FOR

Our Board recommends a FOR vote because it believes the Company’s compensation policies and practices are effective in achieving the Company’s goals of paying for performance and aligning the executives’ long-term interests with those of our shareholders.

|

| Proposal | | Background | | Board Recommendation | | | We are asking shareholders to approve, on an advisory basis, the Company’s executive compensation, including our executive compensation policies and practices and the compensation of our named executive officers, as described in this Proxy Statement beginning on page 28. | | At our 2022 Annual Meeting, nearly 95% of our voting shareholders voted to approve the compensation of our named executive officers. This result clearly demonstrated strong support for our executive compensation policies and practices and the alignment of executive pay to Company performance. | | FOR Our Board recommends a FORvote because it believes the Company’s compensation policies and practices are effective in achieving the Company’s goals of paying for performance and aligning the executives’ long-term interests with those of our shareholders. | |

Objectives and Components of Our Compensation Program | | | Objectives | | Components | The compensation program for our named executive officers is designed to provide a competitive level of total compensation necessary to attract and retain talented and experienced executives. Additionally, our compensation program is intended to motivate and encourage our executives to contribute to our success and reward our executives for leadership excellence and performance that promotes sustainable growth in shareholder value.

| | In Fiscal 2020, the components of our executive compensation program included salary, annual bonus awards, long-term incentive compensation (performance unit awards and UGI Corporation stock option grants), limited perquisites, retirement benefits and other benefits, all as described in greater detail in the Compensation Discussion and Analysis of this Proxy Statement. We believe that the elements of our compensation program are essential components of a balanced and competitive compensation program to support our annual and long-term goals. |

| Objectives | | Components | | | The compensation program for our named executive officers is designed to provide a competitive level of total compensation necessary to attract and retain talented and experienced executives. Additionally, our compensation program is intended to motivate and encourage our executives to contribute to our success and reward our executives for leadership excellence and performance that promotes sustainable growth in shareholder value. | | In Fiscal 2022, the components of our executive compensation program included salary, annual bonus awards, long-term incentive compensation (performance unit awards, restricted stock unit awards, and stock option grants), limited perquisites, retirement benefits and other benefits, all as described in greater detail in the Compensation Discussion and Analysis of this Proxy Statement. We believe that the elements of our compensation program are essential components of a balanced and competitive compensation program to support our short- and long-term goals. | |

Pay for Performance | | | Our executive compensation program allows the Compensation and Management Development Committee of the Board and the Board to determine pay based on a comprehensive view of quantitative and qualitative factors designed to enhance shareholder value and align the long-term interests of executives and shareholders.

We believe that the performance-based components of our compensation program, namely our stock options and performance units, have effectively linked our executives’ compensation to our financial performance.

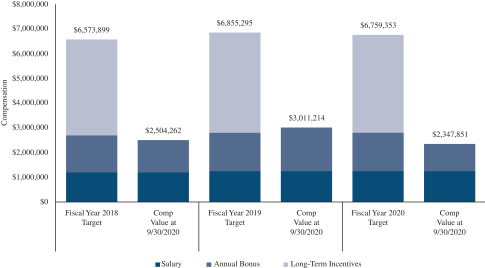

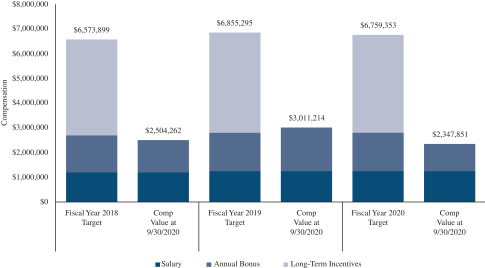

The Company allocates a substantial portion of compensation to performance-based compensation. In Fiscal 2020, 82% of the principal compensation components, in the case of Mr. Walsh, and 70% to 74% of the principal compensation components, in the case of all other

| | named executive officers, were variable and tied to financial performance.

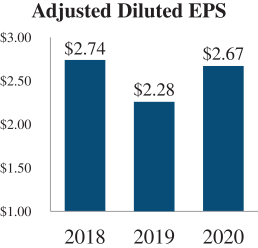

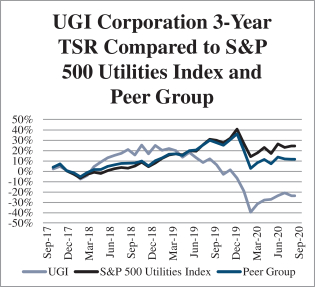

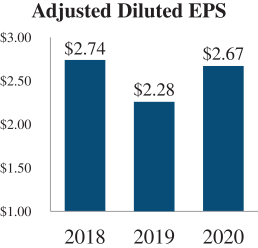

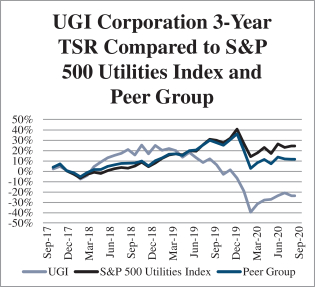

For example, for the 2017-2019 performance period, UGI Corporation’s total shareholder return compared to its peer group was in the 4th percentile (UGI ranked 27th out of the 28 companies in its peer group) and resulted in no performance unit payout in Fiscal 2020. For the 2018-2020 performance period (estimated as of October 31, 2020), UGI Corporation’s total shareholder return compared to its peer group was below the threshold for a payout and no performance unit payout is expected in Fiscal 2021. For additional information on the alignment between our financial results and executive officer compensation, see the Compensation Discussion and Analysis in this Proxy Statement.

|

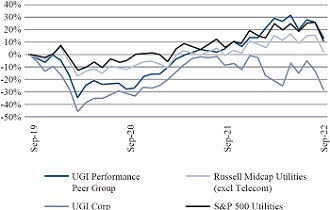

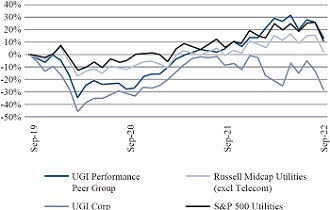

| Our executive compensation program allows the Compensation and Management Development Committee and the Board to determine pay based on a comprehensive view of quantitative and qualitative factors designed to enhance shareholder value and align the long-term interests of executives and shareholders. We believe that the performance-based components of our compensation program, namely our annual bonuses, stock options and performance units, have effectively linked our executives’ compensation to our financial performance.The Company allocates a substantial portion of compensation to performance-based compensation. In Fiscal 2022, 68% of the principal compensation components, in the case of Mr. Perreault, and 57% to | | 60% of the principal compensation components, in the case of all other named executive officers, were variable and tied to performance objectives. For example, for the 2019-2021 performance period, UGI Corporation’s total shareholder return compared to its peer group was below the threshold for a payout and resulted in no performance unit payout in Fiscal 2022. For the 2020-2022 performance period (estimated as of September 30, 2022), UGI Corporation’s total shareholder return compared to its peer group was below the threshold for a payout and no performance unit payout is expected in Fiscal 2023. For additional information on the alignment between our financial results and executive officer compensation, see the Compensation Discussion and Analysis in this Proxy Statement. | |

Corporate Governance and Executive Compensation Practices | | | Corporate Governance | | Executive Compensation | ✓Annual election of directors

✓Majority voting with a director resignation policy for directors not receiving a majority of votes cast in uncontested elections

✓The Board is led by an independent chair

✓Majority of current directors are independent (11 of 12)

✓Regularly scheduled executive sessions of non-management directors

✓Independent Board Committees (with the exception of the Executive Committee), each with authority to retain independent advisors

✓Compensation and Management Development Committee advised by independent compensation consultant

✓Annual Board and Committee self-assessment process

✓No supermajority voting provisions

✓Annual limit of $500,000 on individual director equity awards

✓Meaningful director stock ownership requirements

✓Mandatory retirement age of 75 years for directors

| | ✓Meaningful executive officer stock ownership requirements

✓Policy prohibiting hedging and pledging of Company securities, including the holding of Company securities in margin accounts as collateral for margin loans, by directors and executive officers

✓Termination of employment is required for payment under change-in-control agreements (“double trigger”)

✓Double trigger for the accelerated vesting of equity awards in the event of a change in control

✓No tax gross-ups in change-in-control agreements for any of our named executive officers

✓A substantial portion of executive compensation is allocated to performance-based compensation, including long-term awards, in order to align executive officers’ interests with shareholders’ interests and to enhance long-term performance (82% of the principal components, in the case of Mr. Walsh, and 70% to 74%, in the case of all other named executive officers)

✓Recoupment policy for incentive-based compensation paid or awarded to current and former executive officers in the event of a restatement of financial results due to material non-compliance with any financial reporting requirement

✓Board-reviewed succession plan for CEO and other senior management

|

| Corporate Governance | | Executive Compensation | ✔ Annual election of directors ✔ Majority voting with a director resignation policy for directors not receiving a majority of votes cast in uncontested elections✔ The Board is led by an independent chair ✔ Majority of director-nominees are independent (9 of 10) ✔ Regularly scheduled executive sessions of non-management directors ✔ Independent Board Committees (with the exception of the Executive Committee), each with authority to retain independent advisors ✔ Compensation and Management Development Committee advised by independent compensation consultant ✔ Annual Board and Committee self-assessment process ✔ No supermajority voting provisions ✔ Annual limit of $500,000 on individual director equity awards ✔ Robust director stock ownership requirements ✔ Mandatory retirement age of 75 years for directors | | ✔ Robust executive officer stock ownership requirements ✔ Policy prohibiting hedging and pledging of Company securities, including the holding of Company securities in margin accounts as collateral for margin loans, by directors and executive officers ✔ Termination of employment is required for payment under change-in-control agreements (“double trigger”) ✔ Double trigger for the accelerated vesting of equity awards in the event of a change in control ✔ No tax gross-ups in change-in-control agreements for any of our named executive officers ✔ A substantial portion of executive compensation is allocated to performance-based compensation, including long-term awards, in order to align executive officers’ interests with shareholders’ interests and to enhance long-term performance (68% of the principal components, in the case of Mr. Perreault, and 57% to 60%, in the case of all other named executive officers) ✔ Recoupment policy for incentive-based compensation paid or awarded to current and former executive officers in the event of a restatement of financial results due to material non-compliance with any financial reporting requirement ✔ Board-reviewed succession plan for CEO and other senior management |

| Overview of Director Qualifications and Experience |

The following matrix highlights each director-nominee’s specific skills, knowledge, qualifications and experiences that are relevant to our long-term strategy beyond the minimum qualifications that our Board and Corporate Governance Committee of our Board believe are necessary for all directors. Our Board and Corporate Governance Committee believe that each director-nominee also brings a unique background, personal attributes and a range of expertise and knowledge not reflected in the matrix that provides our Board with an appropriate and diverse mix of skills and attributes necessary for the Board to fulfill its oversight responsibilities to our shareholders. More detailed information on each of our director-nominee’s backgrounds and qualifications is provided in their biographies beginning on page 9. Our Board and the Corporate Governance Committee do not assign specific weights to any of the below skills, knowledge, qualifications and experiences. The following matrix reflects areas of qualifications

| Qualifications/Experience | | | Bort | | | Dosch | | | Harris | | | Hermance | | | Longhi | | | Marrazzo | | | Miller | | | Romano | | | Stallings | | | Perreault | | | Senior Executive Management (CEO, CFO, SVP, Finance) | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | Financial Expertise/Audit Committee Financial Expert | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | Corporate Finance/Financial Strategy/Public Accounting/Finance | | | X | | | X | | | X | | | X | | | | | | X | | | | | | X | | | X | | | X | | | Strategic Planning/Business Development | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | Industry Experience (including natural gas distribution and experience that are relevant to our long-term strategy beyond the minimum qualifications that our Board believes are necessary for all directors. The Corporate Governance Committee of the Board and our Board believe that each director-nominee also brings his/her unique background, personal attributes and a range of expertise and knowledge not reflected in the matrix that provides our Board with an appropriate and diverse mix of skills and attributes necessary for the Board to fulfill its oversight responsibilities to our shareholders. More detailed information is provided in each director-nominee’s biography beginning on page 10.transmission) | | | | | | | | X | | | | | | | | | X | | | | | | | | | | | | | | | | | | | | | Qualifications/Experience | | Bort | | Dosch | | Harris | | Hermance | | Longhi | | Marrazzo | | Miller | | Romano | | Stallings | | Walsh | | | | | | | | | | | | | X | | | Logistics & Distribution | | | | | | X | | | X | | | X | | | X | | | | | | X | | | X | | | | | | X | | | Operational Expertise | | | | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | International Operations | | | X | | | X | | | | | | X | | | X | | | | | | X | | | X | | | X | | | X | | | Asset Management | | | X | | | X | | | X | | | X | | | | | | | | | X | | | | | | | | | X | | | IT Infrastructure/ Technology | | | X | | | X | | | | | | X | | | | | | | | | | | | X | | | X | | | X | | | Risk Management | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | Government Regulation/ Regulated Industry | | | | | | | | | X | | | X | | | | | | X | | | X | | | | | | X | | | X | | | Public Company Board Experience | | | | | | | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | | | | Corporate Governance | | | X | | | X | | | | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | Executive Compensation/HR/ Workforce Management | | | | | | | | | | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | Sales/Marketing/Retail | | | | | | | | | | | | X | | | | | | X | | | X | | | X | | | X | | | X | | Senior Executive Management

|

7 (CEO, CFO, SVP, Finance)

| | X | | X | | X | | X | | X | | X | | X | | X | | X | | X | | | | | | | | | | | | Financial Expertise/Audit Committee Financial Expert | | X | | X | | X | | X | | X | | X | | X | | X | | | | X | | | | | | | | | | | | Corporate Finance/Financial Strategy/Public Accounting/

Finance

| | X | | X | | X | | X | | | | X | | | | X | | X | | X | | | | | | | | | | | | Strategic Planning/Business Development | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X | | | | | | | | | | | | Industry Experience (including natural gas distribution and transmission) | | | | | | X | | | | | | | | | | | | | | X | | | | | | | | | | | | Logistics & Distribution | | | | X | | X | | X | | X | | | | X | | X | | | | X | | | | | | | | | | | | Operational Expertise | | | | X | | X | | X | | X | | X | | X | | X | | X | | X | | | | | | | | | | | | International Operations | | X | | X | | | | X | | X | | | | X | | X | | | | X | | | | | | | | | | | | Asset Management | | X | | X | | X | | X | | | | | | X | | | | | | X | | | | | | | | | | | | IT Infrastructure/

Technology

| | X | | X | | | | X | | | | | | | | X | | X | | X | | | | | | | | | | | | Risk Management | | X | | X | | X | | X | | X | | X | | X | | X | | X | | X | | | | | | | | | | | | Government Regulation/Regulated Industry | | | | | | X | | X | | | | X | | X | | | | X | | X | | | | | | | | | | | | Public Company Board Experience | | | | | | X | | X | | X | | X | | | | X | | X | | X | | | | | | | | | | | | Corporate Governance | | X | | | | | | X | | X | | X | | X | | X | | X | | X | | | | | | | | | | | | Executive Compensation/HR/Workforce Management | | | | | | | | X | | X | | X | | X | | X | | X | | X | | | | | | | | | | | | Sales/Marketing/Retail | | | | | | | | X | | | | X | | X | | X | | | | X |

| QUESTIONS AND ANSWERS ABOUT PROXY MATERIALS, ANNUAL MEETING

AND VOTING

|

This proxy statement contains information related to the Annual Meeting of Shareholders of UGI Corporation to be held on Friday, January 29, 2021, beginning at 9:00 a.m. Eastern Standard Time. The Annual Meeting and any postponements or adjournments thereof will be conducted solely by remote communication through a virtual meeting format, rather than an in-person meeting. This proxy statement was prepared under the direction of the Company’s Board of Directors to solicit your proxy for use at the Annual Meeting. It was made available to shareholders on or about December 18, 2020.

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of printed proxy materials?

The Company has elected to provide access to the proxy materials over the Internet. We believe that this initiative enables the Company to provide proxy materials to shareholders more quickly, reduces the impact of our Annual Meeting on the environment and reduces costs.

Who is entitled to vote?

Only shareholders of record at the close of business on November 18, 2020, the record date, are entitled to vote at the Annual Meeting. On November 18, 2020, there were 208,428,717 shares of common stock outstanding. Each shareholder has one vote per share on all matters to be voted on.

How can I vote my shares held in the Company’s Employee Savings Plans?

You can instruct the trustee for the Company’s Employee Savings Plans to vote the shares of stock that are allocated to your account in the UGI Stock Fund. If you do not vote your shares, the trustee will vote them in proportion to those shares for which the trustee has received voting instructions from participants.

How can I change my vote?

You can change or revoke your vote at any time before polls close at the 2021 Annual Meeting:

If you returned a paper proxy card, you can write to the Company’s Corporate Secretary at our principal office, 460 North Gulph Road, King of Prussia, Pennsylvania 19406, stating that you wish to revoke your proxy and that you need another proxy card.

You can vote again, either over the Internet or by telephone.

If you hold your shares through a broker, bank or other nominee, you can revoke your proxy by

| | contacting the broker, bank or other nominee and following its procedure for revocation.

|

Shareholders of record may change or revoke their proxy at any time before it is exercised at the annual meeting by Internet, telephone, or mail prior to 11:59 p.m. Eastern Daylight Time on Thursday, January 28, 2021, or by attending the virtual annual meeting and following the voting instructions provided on the meeting website. If you are the beneficial owner of shares held in street name, you must follow the instructions provided by your broker, bank, or other holder of record for changing or revoking your proxy. Your last vote is the vote that will be counted.

Table of Contents What is a quorum?A “quorum” is the presence at the meeting, in person or represented by proxy, of the holders of a majority of the outstanding shares entitled to vote. A quorum of the holders of the outstanding shares must be present for the Annual Meeting to be held. Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum.

How are votes, abstentions and broker non-votes counted?

Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum, but are not considered a vote cast under Pennsylvania law.

When a broker, bank or other nominee holding shares on your behalf does not receive voting instructions from you, the broker, bank or other nominee may vote those shares only on matters deemed “routine” by the New York Stock Exchange. On non-routine matters, the broker, bank or other nominee cannot vote those shares unless they receive voting instructions from the beneficial owner. A “broker non-vote” means that a broker has not received voting instructions and either

declines to exercise its discretionary authority to vote on routine matters or is barred from doing so because the matter is non-routine.

As a result, abstentions and broker non-votes are not included in the tabulation of the voting results on issues requiring approval of a majority of the votes cast and, therefore, do not have the effect of votes in opposition in such tabulation.

What vote is required to approve each item?

Item 1 – Election of Directors: Majority of Votes Cast Under our Bylaws and Principles of Corporate Governance, Directors must be elected by a majority of the votes cast in uncontested elections, such as the election of Directors at the Annual Meeting. This means that a director-nominee will be elected to our Board of Directors if the votes cast “FOR” such Director nominee exceed the votes cast “AGAINST” him or her. In addition, an incumbent Director will be required to tender his or her resignation if a majority of the votes cast are not in his or her favor in an uncontested election of Directors. The Corporate Governance Committee would then be required to recommend to the Board of Directors whether to accept the incumbent Director’s resignation, and the Board will have ninety (90) days from the date of the election to determine whether to accept such resignation.

Advisory Approval of Executive Compensation:Majority of Votes Cast

The approval, by advisory vote, of the Company’s executive compensation requires the affirmative vote of a majority of the shares present in person or by proxy and entitled to vote at the 2021 Annual Meeting. This vote is advisory in nature and therefore not binding on UGI Corporation, the Board of Directors or the Compensation and Management Development Committee. However, our Board of Directors and the Compensation and Management Development Committee value the opinions of our shareholders and will consider the outcome of this vote in their future deliberations on the Company’s executive compensation programs.

2021 Incentive Award Plan: Majority of Votes Cast

UGI Corporation’s Board of Directors has approved the UGI Corporation 2021 Incentive Award Plan (the “Plan”) subject to shareholder approval, and is submitting the Plan to the shareholders for approval. The total aggregate number of shares of our common stock that may be

issued under the Plan is 20,500,000 shares. The purpose of the Plan is to provide an incentive to our employees, directors, and consultants to contribute to our economic success by continuing to align their interests with the interests of the shareholders through grants of equity-based awards and cash awards. Information regarding the Plan is set forth in ITEM 3 – APPROVAL OF UGI CORPORATION 2021 INCENTIVE AWARD PLAN of this Proxy Statement.

Ratification of the selection of Ernst & Young LLP:Majority of Votes Cast

The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for Fiscal 2021 requires the affirmative vote of a majority of the votes cast at the meeting to be approved.

Who will count the vote?

Representatives of Broadridge Financial Solutions, Inc. will tabulate the votes cast by proxy or in person at the Annual Meeting and act as inspectors of election.

What are the deadlines for Shareholder proposals for next year’s Annual Meeting?

Shareholders may submit proposals on matters appropriate for shareholder action as follows:

Shareholders who wish to include a proposal in the Company’s proxy statement for the 2022 annual meeting must comply in all respects with the rules of the U.S. Securities and Exchange Commission (“SEC”) relating to such inclusion and must submit the proposals to the Corporate Secretary at our principal office, 460 North Gulph Road, King of Prussia, Pennsylvania 19406, no later than August 20, 2021.

If any shareholder wishes to present a proposal at the 2022 Annual Meeting that is not included in our proxy statement for that meeting, the proposal must be received by the Corporate Secretary at the above address by November 3, 2021. For proposals that are not received by November 3, 2021, the proxy holders will have discretionary authority to vote on the matter without including advice on the nature of the proposal or on how the proxy holders intend to vote on the proposal in our proxy statement.

All proposals and notifications should be addressed to the Corporate Secretary at our

| | principal office, 460 North Gulph Road, King of Prussia, Pennsylvania 19406.

|

How much did this proxy solicitation cost?

The Company has engaged Georgeson Inc. to solicit proxies for the Company for a fee of $8,500 plus reasonable expenses for additional services. We also reimburse banks, brokerage firms and

other institutions, nominees, custodians and fiduciaries for their reasonable expenses for sending proxy materials to beneficial owners and obtaining their voting instructions. Certain Directors, officers and regular employees of the Company and its subsidiaries may solicit proxies personally or by telephone without additional compensation.

| ITEM 1 – ELECTIONOF DIRECTORS

|

|

Ten directors have been nominated by the Board of Directors to stand for election as directors at the Annual Meeting of Shareholders based upon recommendations from the Corporate Governance Committee. Each director-nominee has consented to serve, if elected, until the next Annual Meeting or until his or her earlier resignation or removal. If any director-nominee is not available for election, proxies will be voted for another person nominated by the Board of Directors or the size of the Board will be reduced. At this time, the Board is unaware of any reason why any of the director-nominees may not be able to serve as a director if elected. The Board of Directors has unanimously nominated M. Shawn Bort, Theodore A. Dosch, Alan N. Harris, Frank S. Hermance, Mario Longhi, William J. Marrazzo, Cindy J. Miller, Roger Perreault, Kelly A. Romano, and James B. Stallings, Jr. for election as directors at the 2023 Annual Meeting. As previously announced, John L. Walsh informed the Company of his intent to not stand for reelection to the Company’s Board of Directors at the Company’s 2023 Annual Meeting. NOMINEES

|

Ten directors have been nominated by the Board of Directors to stand for election as directors at the Annual Meeting of Shareholders based upon recommendations from the Corporate Governance Committee. Each director-nominee has consented to serve, if elected, until the next annual meeting or until his or her earlier resignation or removal. If any director-nominee is not available for election, proxies will be voted for another person nominated by the Board of Directors or the size of the Board will be reduced. At this time, the Board of Directors knows no reason why any of the director-nominees may not be able to serve as a director if elected.

Other than Mario Longhi and Cindy J. Miller, who were elected by the Board of Directors to serve as Directors effective April 20, 2020 and September 1, 2020, respectively, all of the director-nominees were elected to the Board by our shareholders at last year’s annual meeting. The Board of Directors has unanimously nominated M. Shawn Bort, Theodore A. Dosch, Alan N. Harris, Frank S. Hermance, Mario Longhi, William J. Marrazzo, Cindy J. Miller, Kelly A. Romano, James B. Stallings, Jr., and John L. Walsh for election as directors at the Annual Meeting. Marvin O. Schlanger previously announced his intention to retire as Vice Chair of the Company’s Board of Directors and to not stand for reelection to the Company’s Board of Directors at the Company’s 2021 Annual Meeting. In addition, as previously announced, K. Richard Turner informed the Company of his intent not to stand for reelection to the Company’s Board of Directors at the Company’s 2021 Annual Meeting.

Information about Director-Nominees Biographical information for each of the director-nominees standing for election is set forth below, as well as a description of the specific experience, qualifications, attributes and skills that led the Board to conclude that, in light of the Company’s business and structure, the individual should serve as a director. The Board believes that each director-nominee has valuable individual skills and experience that, taken as a whole, provide the depth of knowledge, judgment and strategic vision necessary to provide effective oversight of the Company. The Board of Directors recommends that you vote “FOR” the election of each of the ten

nominees for director. |

| | | | |

| | M. SHAWN BORTShawn Bort Retired Senior Vice President,

Finance, Saint-Gobain Corporation Director since 2009

Age 58

Chair, Audit Committee

Member, Pension Committee

|

Principal Occupation and Business Experience:Ms. Bort retired in 2015 as Senior Vice President, Finance of Saint-Gobain Corporation, the North American business of Compagnie de Saint-Gobain (a global manufacturer and distributor of flat glass, building products, glass containers and high performance materials) (2006 to 2015). Ms. Bort was formerly Vice President, Finance (2005 to 2006) and Vice President, Internal Control Services (2002 to 2005) of Saint-Gobain. Prior to joining Saint-Gobain, she was a partner with PricewaterhouseCoopers LLP, a public accounting firm (1997 to 2002), having joined Price Waterhouse in 1984. In connection with the suspension of voluntary reporting obligations under the Securities Exchange act of 1934, as amended (the “Exchange Act”), Ms. Bort also served as a Director of UGI Utilities, Inc. until April 2020.

Key Skills and Qualifications:Ms. Bort’s qualifications to serve as a director include her senior financial executive management experience with a global company, as well as her extensive public accounting knowledge and experience. Her education (Ms. Bort has a bachelor’s degree in accounting from Marquette University and a Master of Business Administration degree in finance and operations management from the Wharton School of the University of Pennsylvania) and experience provide her with financial expertise and a well-developed awareness of IT infrastructure, financial strategy, asset management and risk management. Ms. Bort also possesses international experience by virtue of her former executive position at a large global company and corporate governance experience by virtue of her position on the advisory board at Drexel University’s LeBow College of Business, Center for Corporate Governance.

| | | | |

60 | |  | | Theodore A. Dosch THEODORE A. DOSCH

Retired Executive Vice President of Strategy and Chief Transformation Officer, WESCO International Inc. Director since 2017

Age 6163

Chair, Pension Committee

Member, Audit Committee

|

Principal Occupation and Business Experience:Mr. Dosch is Executive Vice President of Strategy & Chief Transformation Officer of WESCO International Inc. (a leading provider of business-to-business distribution, logistics services and supply chain solutions). He previously served as the Chief Financial Officer (2011-2020) and Senior Vice President, Global Finance (2009 to 2011) of Anixter International Inc. (a leading global distributor of network & security solutions, electrical & electronic solutions and utility power solutions). Prior to joining Anixter International, Mr. Dosch held a number of executive positions with Whirlpool Corporation, including CFO – North America and Vice President, Finance, of Maytag Integration (2006 to 2008), Corporate Controller (2004 to 2006) and CFO – North America (1999 to 2004). In connection with the suspension of voluntary reporting obligations under the Exchange Act, Mr. Dosch also served as a Director of UGI Utilities, Inc. until April 2020.

Key Skills and Qualifications:Mr. Dosch’s qualifications to serve as a director include his senior financial executive management experience at both Anixter International and Whirlpool Corporation. His education (Mr. Dosch has a bachelor’s degree in accounting from Ohio University and is a certified public accountant) and experience provide him with financial expertise. Mr. Dosch possesses international expertise by virtue of his positions at WESCO International Inc., Anixter International, and Whirlpool Corporation, companies with global operations, as well as in-depth experience in the areas of strategic planning, asset management, change management, and risk management.

| | | | | Committee Membership:

Chair, Audit Committee

Member, Executive Committee

Ms. Bort retired in 2015 as Senior Vice President, Finance of Saint-Gobain Corporation, the North American business of Compagnie de Saint-Gobain (a global manufacturer and distributor of flat glass, building products, glass containers and high performance materials) (2006 to 2015). Ms. Bort was formerly Vice President, Finance (2005 to 2006) and Vice President, Internal Control Services (2002 to 2005) of Saint-Gobain. Prior to joining Saint-Gobain, she was a partner with PricewaterhouseCoopers LLP, a public accounting firm (1997 to 2002), having joined Price Waterhouse in 1984. In connection with the suspension of voluntary reporting obligations under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), Ms. Bort also served as a Director of UGI Utilities, Inc. until April 2020.

Key Skills and Qualifications:

Ms. Bort’s qualifications to serve as a director include her senior financial executive management experience with a global company, as well as her extensive public accounting knowledge and experience. Her education (Ms. Bort has a bachelor’s degree in accounting from Marquette University and a Master of Business Administration degree in finance and operations management from the Wharton School of the University of Pennsylvania) and experience provide her with financial expertise and a well-developed awareness of IT infrastructure, financial strategy, asset management and risk management. Ms. Bort also possesses international experience by virtue of her former executive position at a large global company and corporate governance experience by virtue of her position on the advisory board at Drexel University’s LeBow College of Business, Center for Corporate Governance. | | Committee Membership:

Chair, Pension Committee

Member, Audit Committee Principal Occupation and Business Experience:

Mr. Dosch retired in August 2022 as Executive Vice President of Strategy & Chief Transformation Officer of WESCO International Inc. (a leading provider of business-to-business distribution, logistics services and supply chain solutions) (June 2020 to August 2022). He previously served as the Chief Financial Officer (July 2011 to June 2020) and Senior Vice President, Global Finance (2009 to 2011) of Anixter International Inc. (a leading global distributor of network and security solutions, electrical and electronic solutions, and utility power solutions). Prior to joining Anixter International, Mr. Dosch held a number of executive positions with Whirlpool Corporation, including CFO – North America and Vice President, Finance, of Maytag Integration (2006 to 2008), Corporate Controller (2004 to 2005) and CFO – North America (2000 to 2004). Mr. Dosch also held a held a variety of financial related roles at Whirlpool since 1986. In connection with the suspension of voluntary reporting obligations under the Exchange Act, Mr. Dosch also served as a Director of UGI Utilities, Inc. until April 2020. Mr. Dosch currently serves on the Board of Directors of East Penn Manufacturing Co. ALANKey Skills and Qualifications:

Mr. Dosch’s qualifications to serve as a director include his senior financial executive management experience at WESCO International, Anixter International and Whirlpool Corporation. His education (Mr. Dosch has a bachelor’s degree in accounting from Ohio University and is a certified public accountant) and years of experience in financial related roles provide him with financial expertise. Mr. Dosch possesses international expertise by virtue of his positions at WESCO International Inc., Anixter International, and Whirlpool Corporation, companies with global operations, as well as in-depth experience in the areas of strategic planning, asset management, change management, and risk management.

|

| | Alan N. HARRISHarris Retired Senior Advisor and Chief Development and Operations Officer, Spectra Energy Corporation Director since 2018

Age 67

Chair, Safety, Environmental and Regulatory Compliance Committee

Member, Pension Committee

|

Principal Occupation and Business Experience:Mr. Harris retired in January 2015 from Spectra Energy Corporation (an operator in the transmission and storage, distribution and gathering and processing of natural gas) where he served in multiple roles since 2007, including as Senior Advisor to the Chairman, President and Chief Executive Officer on project execution efforts (2014 to 2015), Chief Development Officer and Chief Operations Officer (2008 to 2014) and Chief Development Officer (2007 to 2008). Prior to Spectra

Energy Corporation’s spin-off from Duke Energy Gas Transmission, Mr. Harris held various positions of increasing responsibility at Duke Energy, including Group Vice President, Chief Financial Officer (2004 to 2006), Executive Vice President (2003 to 2004), Senior Vice President, Strategic Development and Planning (2002 to 2003), Vice President, Controller, Treasurer, Strategic Planning (2000 to 2002) and Vice President, Controller, Strategic Planning (1999 to 2000). Mr. Harris currently serves as a Director of Enable Midstream Partners, LP. (an owner, operator and developer of midstream energy infrastructure assets in the U.S.). In connection with the suspension of voluntary reporting obligations under the Exchange Act, Mr. Harris also served as a Director of UGI Utilities, Inc. until April 2020.

Key Skills and Qualifications:Mr. Harris’ extensive background in the energy industry, and in particular natural gas distribution and transmission, provide him with industry expertise. Additionally, Mr. Harris’ experience provides him with strategic planning and business development experience. As a former senior financial executive, Mr. Harris also possesses experience in corporate finance and accounting. His education (Mr. Harris has a bachelor’s degree in accounting from Northeastern Oklahoma State University and an MBA from the University of Tulsa and is a certified public accountant) and experience provide him with financial expertise. Mr. Harris also possesses operational expertise in the energy sector by virtue of his senior executive experience at Spectra Energy and his director experience at Enable Midstream Partners.

| | | | |

69 | |  | | FRANKFrank S. HERMANCEHermance

Retired Chairman and Chief Executive Officer, AMETEK, Inc. Director since 2011

Age 73 | Committee Membership:

Chair, Safety, Environmental and

Regulatory Compliance Committee

Member, Pension Committee Age 71Principal Occupation and Business Experience:

Mr. Harris retired in January 2015 from Spectra Energy Corporation (an operator in the transmission and storage, distribution and gathering and processing of natural gas) where he served in multiple roles since 2007, including as Senior Advisor to the Chairman, President and Chief Executive Officer on project execution efforts (2014 to 2015), Chief Development Officer and Chief Operations Officer (2009 to 2013) and Chief Development Officer (2007 to 2009). Prior to Spectra Energy Corporation’s spin-off from Duke Energy Gas Transmission, Mr. Harris held various positions of increasing responsibility at Duke Energy, including Group Vice President, Chief Financial Officer (2004 to 2006), Executive Vice President (2003 to 2004), Senior Vice President, Strategic Development and Planning (2002 to 2003), Vice President, Controller, Treasurer, Strategic Planning (2000 to 2002) and Vice President, Controller, Strategic Planning (1999 to 2000). Mr. Harris previously served as a Director of Enable Midstream Partners, LP (an owner, operator and developer of midstream energy infrastructure assets in the United States) until the company was acquired in 2021. In connection with the suspension of voluntary reporting obligations under the Exchange Act, Mr. Harris also served as a Director of UGI Utilities, Inc. until April 2020.

Key Skills and Qualifications:

Mr. Harris’ extensive background in the energy industry, and in particular natural gas distribution and transmission, provide him with industry expertise. Additionally, Mr. Harris’ experience provides him with strategic planning and business development expertise. As a former senior financial executive, Mr. Harris also possesses experience in corporate finance and accounting. His education (Mr. Harris has a bachelor’s degree in accounting from Northeastern Oklahoma State University and an MBA from the University of Tulsa and is a certified public accountant) and experience provide him with financial expertise. Mr. Harris also possesses operational expertise in the energy sector by virtue of his senior executive experience at Spectra Energy and his director experience at Enable Midstream Partners. | | Chair of the Board

Committee Membership:

Chair, Corporate Governance Committee

Chair, Executive Committee

Principal Occupation and Business Experience:

Mr. Hermance serves as the Company’s Chair of the Board (since January 2020). He is the retired Chairman (2001 to 2017) and Chief Executive Officer (1999 to 2016) of AMETEK, Inc. (a global manufacturer of electronic instruments and electromechanical devices). He previously served as AMETEK’s President and Chief Operating Officer (1996 to 1999). Mr. Hermance also serves as Director Emeritus of the Greater Philadelphia Alliance for Capital and Technologies, as Vice Chairman of the World Affairs Council of Philadelphia, and as an advisory board member at American Securities LLP (a private equity firm). He previously served as a director of IDEX Corporation, as a member of the Board of Trustees of the Rochester Institute of Technology and as a Director of AmeriGas Propane, Inc., a subsidiary of the Company, until its merger into UGI Corporation in August 2019. In connection with the suspension of voluntary reporting obligations under the Exchange Act, Mr. Hermance also served as a Director of UGI Utilities, Inc. until April 2020. Key Skills and Qualifications:

Mr. Hermance’s qualifications to serve as a director include his extensive senior management experience in the roles of Chairman, Chief Executive Officer, President and Chief Operating Officer of a large global company. The Board also considered Mr. Hermance’s relevant experience in the areas of international operations, logistics, distribution, risk management, mergers and acquisitions, corporate governance, human resources management and executive compensation. |

Principal Occupation and Business Experience:Mr. Hermance serves as the Company’s Chairman10

Table of the Board (since January 2020). He is the retired Chairman (2001 to 2017) and Chief Executive Officer (1999 to 2016) of AMETEK, Inc. (a global manufacturer of electronic instruments and electromechanical devices). He previously served as AMETEK’s President and Chief Operating Officer (1996 to 1999). Mr. Hermance serves as Director Emeritus of the Greater Philadelphia Alliance for Capital and Technologies, as Vice Chairman of the World Affairs Council of Philadelphia, and as an advisory board member at American Securities LLP (a private equity firm). He previously served as a member of the Board of Trustees of the Rochester Institute of Technology (until November 2016) and as a Director of AmeriGas Propane, Inc., a subsidiary of the Company, until its merger into UGI Corporation in August 2019. In connection with the suspension of voluntary reporting obligations under the Exchange Act, Mr. Hermance also served as a Director of UGI Utilities, Inc. until April 2020.Contents Key Skills and Qualifications:Mr. Hermance’s qualifications to serve as a director include his extensive senior management experience in the roles of Chairman, Chief Executive Officer, President and Chief Operating Officer of a large global company. The Board also considered Mr. Hermance’s relevant experience in the areas of international operations, logistics, distribution, risk management, mergers and acquisitions, corporate governance, human resources management and executive compensation.

| | | | |

| | MARIO LONGHIMario Longhi

Retired Chief Executive Officer,

United States Steel Corporation Director since 2020

Age 68 | |  | | William J. Marrazzo Chief Executive Officer and

President, WHYY, Inc. Director since April 2020 2019

Age 66 73 |

Principal Occupation and Business Experience:Committee Membership:

Member, Compensation and Management Development

Committee Principal Occupation and Business Experience:

Mr. Longhi retired in 2017 as the Chief Executive Officer of United States Steel Corporation (a leading integrated steel producer) (February 2017 to May 2017). Mr. Longhi was formerly President and Chief Executive Officer (September 2013 to February 2017), President and Chief Operating Officer (June 2013 to September 2013), and Executive Vice President and Chief Operating Officer (July 2012 to June 2013) of United States Steel Corporation. Prior to joining United States Steel Corporation, he served as Chief Executive Officer and President (2006 to 2011) and President (2005 to 2006) of Gerdau Ameristeel Corporation. Mr. Longhi spent 23 years at Alcoa, Inc. prior to that, where he served in various roles of increasing responsibility since 1982, including as President – Alcoa Wheels International, President – Alcoa Forgings Division, President and Chief Executive Officer – Howmet Castings, and Alcoa Vice President and Group President – Global Extrusions. Mr. Longhi is currently a director of Harsco Corporation (a global provider of environmental solutions for industrial and specialty waste streams and innovative technologies for the rail sector) and ITT Inc. (a leading manufacturer of highly engineered critical components and customized technology solutions for the transportation, industrial, and oil and gas markets). Key Skills and Qualifications:Mr. Longhi’s qualifications to serve as a director include his extensive senior management, strategic planning, business development, and operational experience, which he gained through his roles as President, Chief Executive Officer, and Chief Operating Officer of global, publicly traded companies. Mr. Longhi also possesses in-depth knowledge in the areas of executive compensation and international operations

| | | | |

| | WILLIAM J. MARRAZZO

Chief Executive Officer and President WHYY,(2006 to 2011) and President (2005 to 2006) of Gerdau Ameristeel Corporation (a producer of long steel). Mr. Longhi spent 23 years at Alcoa, Inc. prior to that, where he served in various roles of increasing responsibility since 1982, including as President – Alcoa Wheels International, President – Alcoa Forgings Division, President and Chief Executive Officer – Howmet Castings, and Alcoa Vice President and Group President – Global Extrusions. Mr. Longhi is currently a director of Harsco Corporation (a global provider of environmental solutions for industrial and specialty waste streams and innovative technologies for the rail sector). Mr. Longhi also previously served on the board of directors of ITT Inc. (a leading manufacturer of highly engineered critical components and customized technology solutions for the transportation, industrial, and oil and gas markets). Key Skills and Qualifications:

Mr. Longhi’s qualifications to serve as a director include his extensive senior management, strategic planning, business development, corporate governance, risk management, and operational experience, which he gained through his roles as President, Chief Executive Officer, and Chief Operating Officer of global, publicly traded companies as well as his service on public company boards. Mr. Longhi also possesses in-depth knowledge in the areas of executive compensation and international operations. | | Director since September 2019

Age 71

Committee Membership:

Member, Corporate Governance Committee

Member, Compensation and Management Development

Committee

Principal Occupation and Business Experience:

Mr. Marrazzo is Chief Executive Officer and President of WHYY, Inc., a public television and radio company in the nation’s fourth largest market (since 1997). Previously, he was Chief Executive Officer and President of Roy F. Weston, Inc., a publicly traded corporation (1988 to 1997), served as Water Commissioner for the Philadelphia Water Department (1971 to 1988) and was Managing Director for the City of Philadelphia (1983 to 1984). Mr. Marrazzo previously served as a member of the board of American Water Works Company, Inc. (2003 to 2016) and as a Director of Woodard and Curran (a national engineering firm) (2001 to 2011). Mr. Marrazzo previously served as a Director of AmeriGas Propane, Inc., a subsidiary of the Company, from 2001 until its merger with UGI Corporation in August 2019. Mr. Marrazzo also served as a Director of UGI Utilities, Inc. from September 2019 until April 2020. Key Skills and Qualifications:

Mr. Marrazzo’s qualifications to serve as a director include his extensive experience as Chief Executive Officer of both non-profit and public companies as well as his city government leadership experience. Mr. Marrazzo’s senior-level executive experience in both the public and private sectors provide him with financial, strategic planning, risk management, business development and operational expertise. Additionally, by virtue of his 18 years as a member, including six as Chair, of the AmeriGas Propane, Inc. Audit Committee and his 16 years as a member of its Compensation/Pension Committee, as well as his extensive service on other public company boards, Mr. Marrazzo possesses extensive corporate governance, executive compensation, human resources management and audit committee financial expertise. |

Principal Occupation and Business Experience:Mr. Marrazzo is Chief Executive Officer and President11

Table of WHYY, Inc., a public television and radio company in the nation’s fourth largest market (since 1997). Previously, he was Chief Executive Officer and President of Roy F. Weston, Inc., a publicly traded corporation (1988 to 1997), served as Water Commissioner for the Philadelphia Water Department (1971 to 1988) and was Managing Director for the City of Philadelphia (1983 to 1984). Mr. Marrazzo previously served as a member of the board of American Water Works Company, Inc. (2003 to 2016), and as a director of Woodard and Curran (a national engineering firm) (2001 to 2011). Mr. Marrazzo previously served as a director of AmeriGas Propane, Inc., a subsidiary of the Company, from 2001 until its merger with UGI Corporation in August 2019. Mr. Marrazzo also served as a Director of UGI Utilities, Inc. from September 2019 until April 2020. Key Skills and Qualifications:Mr. Marrazzo’s qualifications to serve as a director include his extensive experience as Chief Executive Officer of both non-profit and public companies, and his city government leadership experience. Mr. Marrazzo’s senior-level executive experience in both the public and private sectors provide him with financial, strategic planning, risk management, business development and operational expertise. Additionally, by virtue of his 18 years as a member, including six as Chair, of the AmeriGas Propane, Inc. Audit Committee and his 16 years as a member of its Compensation/Pension Committee, Mr. Marrazzo possesses extensive executive compensation, human resources management and audit committee financial expertise.Contents

| | | | | | Cindy J. Miller

Officer, Stericycle, Inc.

Director since 2020

Age 60 | |  | | CINDY J. MILLERRoger Perreault

President and Chief Executive Officer Stericycle, Inc. of UGI Corporation Director since September 2020 2021

Age 58 |

Principal Occupation and Business Experience: Ms. Miller has been serving as the President and Chief Executive Officer of Stericycle, Inc. (a business-to-business services company and provider of compliance-based solutions, including regulated waste management, secure information destruction, compliance, customer contact, and brand protection) since May 2019. Previously, she held the role of President and Chief Operating Officer of Stericycle (October 2018 to May 2019). Prior to joining Stericycle, Ms. Miller served in various roles of increasing responsibility at the United Parcel Service (UPS) since 1988, including as President, Global Freight Forwarding (2016 to 2018), President, Europe Region (2013 to 2016), Managing Director, UPS UK (2010 to 2013), Managing Director, UPS South Europe, Middle East and Africa (2008 to 2010), District Manager, UPS Metro Chicago (2004 to 2008) and District Manager, UPS Northern Plains (2001 to 2004). Ms. Miller began her career at UPS as a package car driver before taking on various operations manager roles. Ms. Miller is currently a director of Stericycle.

Key Skills and Qualifications: Ms. Miller’s qualifications to serve as a director include her extensive senior management, operational, and strategic planning experience from her leadership roles at global, publicly traded companies. Ms. Miller also possesses extensive knowledge in the areas of logistics, change management, and international operations.

| | | | | Committee Membership:

Member, Pension Committee

Member, Safety, Environmental and Regulatory

Compliance Committee

Ms. Miller has been serving as the President and Chief Executive Officer of Stericycle, Inc. (a business-to-business services company and provider of compliance-based solutions, including regulated waste management, secure information destruction, compliance, customer contact, and brand protection) since May 2019. Previously, she held the role of President and Chief Operating Officer of Stericycle (October 2018 to May 2019). Prior to joining Stericycle, Ms. Miller served in various roles of increasing responsibility at the United Parcel Service (UPS) since 1988, including as President, Global Freight Forwarding (2016 to 2018), President, Europe Region (2013 to 2016), Managing Director, UPS UK (2010 to 2013), Managing Director, UPS South Europe, Middle East and Africa (2008 to 2010), District Manager, UPS Metro Chicago (2004 to 2008) and District Manager, UPS Northern Plains (2001 to 2004). Ms. Miller began her career at UPS as a package car driver before taking on various operations manager roles. Ms. Miller is currently a director of Stericycle.

Key Skills and Qualifications:

Ms. Miller’s qualifications to serve as a director include her extensive senior management, operational, and strategic planning experience from her leadership roles at global, publicly traded companies. Ms. Miller also possesses extensive knowledge in the areas of logistics, business transformation and change management, safety and international operations. | | Committee Membership:

Member, Executive Committee Principal Occupation and Business Experience:

Mr. Perreault is a Director, President and Chief Executive Officer of UGI Corporation (since June 2021). He previously served as Executive Vice President, Global LPG (2018 to 2021) and President - UGI International, LLC (2015 to 2021). Prior to joining UGI Corporation, Mr. Perreault held various positions at Air Liquide, an industrial gases company he joined in 1994, and served in various leadership positions from 2008 to 2014, including in a global role as President, Large Industries, with international responsibilities and, prior to that, in a role with responsibility for Air Liquide’s North American large industries business. Prior to joining Air Liquide, Mr. Perreault was a chemical engineer and operations manager with I.C.I. in Quebec, Canada. KELLYKey Skills and Qualifications:

Mr. Perreault’s qualifications to serve as a director include his extensive strategic planning, logistics, distribution, international and operational experience as well as his executive leadership experience as the Company’s President and Chief Executive Officer and Executive Vice President, Global LPG, as well as his previous service as the Company’s President - UGI International, LLC and his prior senior management experience at a global company. Mr. Perreault has extensive knowledge of the Company’s businesses, international operations, competition, and risks as well as the Company’s environmental, social and governance initiatives. Mr. Perreault also has in-depth management development experience.

|

| | Kelly A. ROMANORomano Founder and Chief Executive

Officer, BlueRipple Capital, LLC Director since 2019

Age 60 | |  | | James B. Stallings, Jr. Chief Executive Officer, PS27

Ventures Director since January 2019 2015

Age 5867 | Committee Membership:

Member, Audit Committee

Member, Safety, Environmental and Regulatory Compliance Committee

|

Principal Occupation and Business Experience:Ms. Romano is the Founder and Chief Executive Officer of BlueRipple Capital, LLC, a consultancy firm focused on strategy, acquisitions, deal structure, and channel development for high technology companies and private equity firms. Ms. Romano retired from United Technologies Corporation (a diversified company that provides high technology products and services to the building and aerospace industries) in 2016 after serving in various positions of increasing responsibility since 1984. From 1993 to 2016, Ms. Romano held a number of senior executive positions at United Technologies Corporation, including President, Intelligent Building Technologies, Building Systems & Services (September 2014 to April 2016), Corporate Vice President, Business Development, UTC Corporate Headquarters (March 2012 to September 2014), President, Global Security Products, UTC Fire & Security (May 2011 to February 2012), Senior Vice President, Global Sales & Marketing, UTC Fire & Security (January 2010 to April 2011), and President, Building Systems & Services, Carrier Corporation (January 2006 to December 2009). Ms. Romano has been an executive advisory board member of Gryphon Investors (a private equity firm focused on middle-market investment opportunities) since December 2016; a senior advisory partner of Sand Oak Capital Partners, LLC (a private equity firm focused on investments in industrial and manufacturing companies in the U.S.) since May 2016; managing partner of Xinova, LLC (an innovation development and banking firm) May 2016-January 2020; a director and co-chair of the Board of Potter Electric Signal (a leading sprinkler monitoring and fire-life safety company)

since December 2017; a director of start-up 75F since August 2020 and an operating partner of AE Industrial Partners, LP (a private equity firm focused on aerospace and industrial investments) since August 2020. Ms. Romano is currently a director of Dorman Products, Inc. In connection with the suspension of voluntary reporting obligations under the Exchange Act, Ms. Romano also served as a Director of UGI Utilities, Inc. until April 2020.

Key Skills and Qualifications: Ms. Romano’s qualifications to serve as a director include her extensive global senior management experience at United Technologies Corporation and her operational, technology, sales, marketing, distribution, strategic planning and leadership, business development, corporate governance, and executive compensation knowledge and expertise.

| | | | |